I shared a tiny preview of my Penvelope 13 from Franklin-Christoph earlier this month and am back now for a more detailed look.

I had originally ordered two of the Penvelopes that would hold six pens each. Unfortunately, they only had one to send me right away – so I was offered the option of waiting another week or upgrading to the “Lucky 13” at no charge. I took the upgrade offer and received it in the Black Crocodile style (pictured here). The P-6 (which I don’t have pictures of yet) is Boot Brown.

As advertised, it holds 13 pens.

Mr. P snuck one pen out of the holder because he’d ordered a super-secret surprise pen for me (more on that another day).

Without any kind of stretching or straining, it holds some of my biggest pens. I tested with a Montblanc 149 – no problem. The two pens on the left are Waterman Edsons – again, no problems at all. No touching, no rubbing.

|

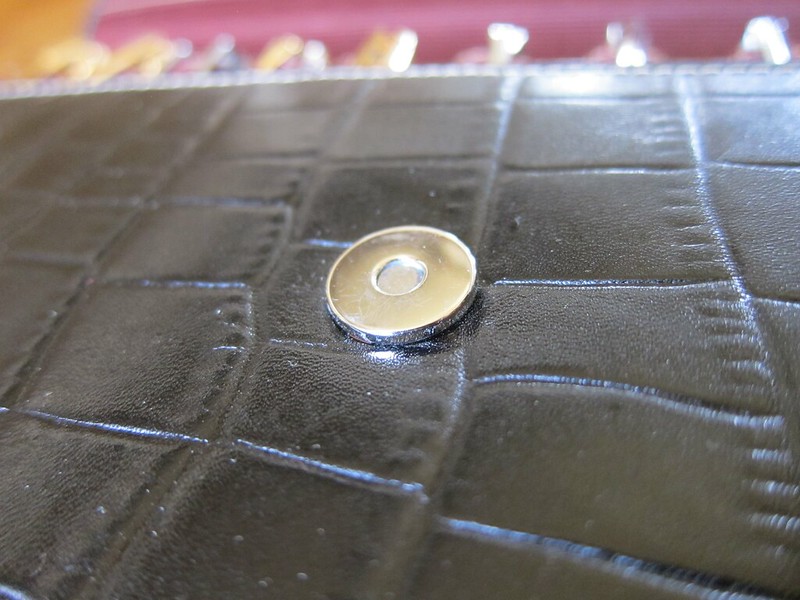

| Magnetic Snap Closure |

|

| High quality interior fabric |

|

| Impeccable Stitching |

I’m in love. Fashion and function. High quality. Excellent customer service (they even called to check in after the items were received). Highly recommended.

The interface is great support, and I enjoy testing new tokens here. The dashboard gives a complete view of my holdings.

гидроизоляция подвала снаружи цены [url=https://gidroizolyacziya-podvala-iznutri-czena5.ru/]gidroizolyacziya-podvala-iznutri-czena5.ru[/url] .

цена ремонта подвала [url=https://gidroizolyacziya-podvala-iznutri-czena4.ru/]gidroizolyacziya-podvala-iznutri-czena4.ru[/url] .

усиление проёмов при перепланировке [url=https://usilenie-proemov5.ru/]usilenie-proemov5.ru[/url] .

list of 24 hour pharmacies

Как выбрать жильё посуточно

1. Определите бюджет и даты поездки.

2. Поставьте приоритеты — комфорт, стоимость или расположение.

3. Ориентируйтесь на отзывы клиентов.

4. Бронируйте заранее.

жилье на сутки

@airbn@b77 https://sutochny.ru/bilety-oteli/

canadian pharmacies top best

Having a stylish appearance is essential for making a good impression.

It helps express personality and boost self-esteem.

A coordinated look shapes first impressions.

In daily life, clothing can add confidence.

https://telegra.ph/Chanel-12-25-4

A carefully curated wardrobe facilitate communication.

It is important to consider personal preferences and suitability for the occasion.

Modern styles allow people to experiment with looks.

Overall, dressing stylishly helps feel confident.

Having a stylish appearance is important for personal expression.

It helps highlight individuality and boost self-esteem.

Well-chosen clothes affects social perception.

In daily life, clothing can enhance personal image.

https://telegra.ph/Alaia-12-25

Thoughtful clothing choices support professional encounters.

It is important to consider individual taste and appropriate setting.

Current trends allow people to explore new ideas.

Overall, dressing stylishly helps feel confident.

гидроизоляция цена москва [url=https://gidroizolyacziya-czena4.ru/]gidroizolyacziya-czena4.ru[/url] .

гидроизоляция цена за рулон [url=https://gidroizolyacziya-czena5.ru/]гидроизоляция цена за рулон[/url] .

Новости Днепр https://u-misti.dp.ua последние события Днепра и области. Транспорт, обзоры, все о Днепре на одном сайте

Давайте разберем тайны и истории, стоящие за легендарными дерби…

Зацепил раздел про Хроники и тактика футбольных дерби.

Вот, можете почитать:

[url=https://tottenham-army.ru]https://tottenham-army.ru[/url]

Поделитесь своими впечатлениями и воспоминаниями о захватывающих дерби…

усиление проёмов под панорамные окна [url=https://usilenie-proemov6.ru/]usilenie-proemov6.ru[/url] .

Умение стильно одеваться является значимым фактором в формировании образа.

Она помогает выразить характер и ощущать внутренний комфорт.

Современный стиль влияет на восприятие окружающих.

В повседневной жизни одежда может повышать самооценку.

https://telegra.ph/Versace-12-25-5

Продуманный гардероб облегчает деловое общение.

При выборе одежды важно учитывать собственный вкус и контекст.

Актуальные стили дают возможность экспериментировать.

Таким образом, умение стильно одеваться положительно влияет на самоощущение.

Продуманный внешний вид играет важную роль в формировании образа.

Она помогает передать личный стиль и выглядеть гармонично.

Аккуратный внешний вид создаёт впечатление окружающих.

В повседневной жизни одежда может повышать самооценку.

https://telegra.ph/Moda-2026-kogda-tkan-nachinaet-dumat-a-stil–chuvstvovat-12-25

Продуманный гардероб облегчает деловое общение.

При выборе одежды важно учитывать личные предпочтения и контекст.

Современные тенденции дают возможность экспериментировать.

Таким образом, умение стильно одеваться положительно влияет на самоощущение.

гидроизоляция цена за рулон [url=https://gidroizolyacziya-czena5.ru/]гидроизоляция цена за рулон[/url] .

safe reliable canadian pharmacy

подвал дома ремонт [url=https://gidroizolyacziya-podvala-iznutri-czena5.ru/]gidroizolyacziya-podvala-iznutri-czena5.ru[/url] .

усиление проема металлом [url=https://usilenie-proemov5.ru/]усиление проема металлом[/url] .

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]tripscan top[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]trip scan[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]трипскан[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

tripscan top

https://trips62.cc

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]трип скан[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]tripscan top[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]tripscan[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

трип скан

https://trips62.cc

Fast onboarding, stable performance, and a team that actually cares. Charts are accurate and load instantly.

I personally find that i’ve been using it for a week for fiat on-ramp, and the wide token selection stands out.

I personally find that wow! This is a cool platform. They really do have the low fees. The updates are frequent and clear.

This platform exceeded my expectations with useful analytics and fast transactions.

гидроизоляция цена москва [url=https://gidroizolyacziya-czena4.ru/]gidroizolyacziya-czena4.ru[/url] .

I value the fast transactions and stable performance. This site is reliable.

Fast onboarding, scalable features, and a team that actually cares. Great for cross-chain swaps with minimal slippage.

CBS News editor in chief Bari Weiss decided to shelve a planned “60 Minutes” story titled “Inside CECOT,” creating an uproar inside CBS, but the report has reached a worldwide audience anyway.

[url=https://minexchange.net]mine exchange[/url]

On Monday, some Canadian viewers noticed that the pre-planned “60 Minutes” episode was published on a streaming platform owned by Global TV, the network that has the rights to “60 Minutes” in Canada.

[url=https://minexchange.net]mine шахта[/url]

The preplanned episode led with correspondent Sharyn Alfonsi’s story — the one that Weiss stopped from airing in the US because she said it was “not ready.”

[url=https://minexchange.net]mine шахта[/url]

Several Canadian viewers shared clips and summaries of the story on social media, and within hours, the videos went viral on platforms like Reddit and Bluesky.

“Watch fast,” one of the Canadian viewers wrote on Bluesky, predicting that CBS would try to have the videos taken offline.

Related article

The Free Press’ Honestly with Bari Weiss (pictured) hosts Senator Ted Cruz presented by Uber and X on January 18, 2025 in Washington, DC.

Inside the Bari Weiss decision that led to a ‘60 Minutes’ crisis

Progressive Substack writers and commentators blasted out the clips and urged people to share them. “This could wind up being the most-watched newsmagazine segment in television history,” the high-profile Trump antagonist George Conway commented on X.

A CBS News spokesperson had no immediate comment on the astonishing turn of events.

Alfonsi’s report was weeks in the making. Weiss screened it for the first time last Thursday night. The story was finalized on Friday, according to CBS sources, and was announced in a press release that same day.

On Saturday morning, Weiss began to change her mind about the story and raised concerns about its content, including the lack of responses from the relevant Trump administration officials.

But networks like CBS sometimes deliver taped programming to affiliates like Global TV ahead of time. That appears to be what happened in this case: The Friday version of the “60 Minutes” episode is what streamed to Canadian viewers.

The inadvertent Canadian stream is “the best thing that could have happened,” a CBS source told CNN on Monday evening, arguing that the Alfonsi piece is “excellent” and should have been televised as intended.

People close to Weiss have argued that the piece was imbalanced, however, because it did not include interviews with Trump officials.

Weiss told staffers on Monday, “We need to be able to get the principals on the record and on camera.” However, in an earlier memo to colleagues, Alfonsi asserted that her team tried, and their “refusal to be interviewed” was “a tactical maneuver designed to kill the story.”

At the end of the segment that streamed on Global TV’s platform, Alfonsi said Homeland Security “declined our request for an interview and referred all questions about CECOT to El Salvador. The government there did not respond to our request.”

The segment included sound bites from President Trump and Homeland Security Secretary Kristi Noem. But it was clearly meant to be a story about Venezuelan men deported to El Salvador, not about the officials who implemented Trump’s mass deportation policy.

mine exchange

https://minexchange.net

усиление проему [url=https://usilenie-proemov6.ru/]usilenie-proemov6.ru[/url] .

I value the intuitive UI and scalable features. This site is reliable.

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]trip scan[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]трипскан вход[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]trip scan[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

трипскан

https://trips62.cc

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]трипскан сайт[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]трипскан[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]трипскан[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

tripscan

https://trips62.cc

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]трипскан вход[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]tripscan[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]tripskan[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

trip scan

https://trips62.cc

News about Poltava on https://u-misti.poltava.ua covers the main and interesting events in Poltava and the surrounding region. The site features transport updates, blogs, and local events.

CBS News editor in chief Bari Weiss decided to shelve a planned “60 Minutes” story titled “Inside CECOT,” creating an uproar inside CBS, but the report has reached a worldwide audience anyway.

[url=https://minexchange.net]mine шахта[/url]

On Monday, some Canadian viewers noticed that the pre-planned “60 Minutes” episode was published on a streaming platform owned by Global TV, the network that has the rights to “60 Minutes” in Canada.

[url=https://minexchange.net]mine exchange[/url]

The preplanned episode led with correspondent Sharyn Alfonsi’s story — the one that Weiss stopped from airing in the US because she said it was “not ready.”

[url=https://minexchange.net]mine шахта[/url]

Several Canadian viewers shared clips and summaries of the story on social media, and within hours, the videos went viral on platforms like Reddit and Bluesky.

“Watch fast,” one of the Canadian viewers wrote on Bluesky, predicting that CBS would try to have the videos taken offline.

Related article

The Free Press’ Honestly with Bari Weiss (pictured) hosts Senator Ted Cruz presented by Uber and X on January 18, 2025 in Washington, DC.

Inside the Bari Weiss decision that led to a ‘60 Minutes’ crisis

Progressive Substack writers and commentators blasted out the clips and urged people to share them. “This could wind up being the most-watched newsmagazine segment in television history,” the high-profile Trump antagonist George Conway commented on X.

A CBS News spokesperson had no immediate comment on the astonishing turn of events.

Alfonsi’s report was weeks in the making. Weiss screened it for the first time last Thursday night. The story was finalized on Friday, according to CBS sources, and was announced in a press release that same day.

On Saturday morning, Weiss began to change her mind about the story and raised concerns about its content, including the lack of responses from the relevant Trump administration officials.

But networks like CBS sometimes deliver taped programming to affiliates like Global TV ahead of time. That appears to be what happened in this case: The Friday version of the “60 Minutes” episode is what streamed to Canadian viewers.

The inadvertent Canadian stream is “the best thing that could have happened,” a CBS source told CNN on Monday evening, arguing that the Alfonsi piece is “excellent” and should have been televised as intended.

People close to Weiss have argued that the piece was imbalanced, however, because it did not include interviews with Trump officials.

Weiss told staffers on Monday, “We need to be able to get the principals on the record and on camera.” However, in an earlier memo to colleagues, Alfonsi asserted that her team tried, and their “refusal to be interviewed” was “a tactical maneuver designed to kill the story.”

At the end of the segment that streamed on Global TV’s platform, Alfonsi said Homeland Security “declined our request for an interview and referred all questions about CECOT to El Salvador. The government there did not respond to our request.”

The segment included sound bites from President Trump and Homeland Security Secretary Kristi Noem. But it was clearly meant to be a story about Venezuelan men deported to El Salvador, not about the officials who implemented Trump’s mass deportation policy.

mine.exchange

https://minexchange.net

I personally find that this platform exceeded my expectations with wide token selection and robust security.

Všude jsem hledal tyto informace.

I personally find that the portfolio tracking process is simple and the quick deposits makes it even better.

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]tripscan[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]трипскан вход[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]трип скан[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

tripscan top

https://trips62.cc

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]трипскан сайт[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]tripscan top[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]tripscan top[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

трипскан вход

https://trips62.cc

You don’t get labeled the “Oracle of Omaha” for nothing.

[url=https://trips62.cc]trip scan[/url]

As one of the world’s most successful investors, Warren Buffett’s views on markets, companies and the economy have always been of great interest on Wall Street and Main Street.

[url=https://trips62.cc]трипскан сайт[/url]

Now 95, Buffett is stepping down as CEO of Berkshire Hathaway, 60 years after taking a controlling share in the company.

[url=https://trips62.cc]трипскан сайт[/url]

But during his long tenure Buffett has had plenty of sensible things to say about how to invest well and live a good life through the work you choose and the way you treat people.

Here’s just a sampling:

Don’t lose money

“The first rule in investment is don’t lose. And the second rule in investment is don’t forget the first rule.”

Buffett is best known as a value investor – someone who buys companies he believes are undervalued. “If you buy things for far below what they’re worth and you buy a group of them, you basically don’t lose money,” he explained on Adam Smith’s Money World.

But Buffett’s advice also speaks to the need to diversify risk.

“It’s the foundation of how I manage client money,” said certified financial planner and CPA Brian Kearns. “Investing is about growth, but it is also about capital preservation. … Find reasonably priced investments … but don’t risk too much of your net worth on one idea.”

It also means investing across asset classes. “They all have different risk profiles and, when combined, allow you to hold investments for the long term because you will experience less volatility,” Kearns said.

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, in 2008.

Warren Buffett’s life in pictures

42 photos

Warren Buffett greets shareholders during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 3, 2008. Carlos Barria/Reuters

Focus on the essentials

трипскан

https://trips62.cc

WOW just what I was searching for. Came here by searching for %keyword%

http://test.jmjplumbing.com.au/iptv/abonnement-atlas-pro-en-2025-details-avantages-et-points-a-verifier/

Evinizi hem islevsel hem de estetik ac?dan zenginlestirecek yarat?c? onerilerle kars?n?zday?z!

Зацепил раздел про Yarat?c? El Sanatlar? ve Ev Dekorasyonu Ipuclar?.

Ссылка ниже:

[url=https://kendimacera.com]https://kendimacera.com[/url]

Umar?m bu ipuclar? evinizi daha s?cak ve ozgun bir hale getirmenize yard?mc? olur.

выездной специалист нарколог [url=https://narkolog-na-dom-4.ru/]narkolog-na-dom-4.ru[/url] .

гидроизоляция подвала услуга [url=https://gidroizolyacziya-podvala-samara2.ru/]гидроизоляция подвала услуга[/url] .

инъекционная гидроизоляция частный дом [url=https://inekczionnaya-gidroizolyacziya4.ru/]inekczionnaya-gidroizolyacziya4.ru[/url] .

наркологическая служба [url=https://narkologicheskaya-klinika-48.ru/]narkologicheskaya-klinika-48.ru[/url] .

акрилатная инъекционная гидроизоляция [url=https://inekczionnaya-gidroizolyacziya5.ru/]inekczionnaya-gidroizolyacziya5.ru[/url] .